Hey, everyone! I’m not sure if I’ve mentioned before that I live in Houston. As you are probably aware by now, we got hit by a destructive hurricane last week. I wrote this post the Sunday before Hurricane Beryl, with plans to do one more readthrough and post it on the following Monday. But last Monday morning, the hurricane hit and we lost power, internet, and the majority of our cell phone signal. We were without power for a solid week. We’ve never lost power for that long. And the days hit over 100 degrees with the heat index. Most of my energy went to sweating, surviving, and being angry at the power company. It was an incredibly stressful week.

I guess there’s a lesson to be learned here about not putting things off until the next day, or maybe one about taking certain modern luxuries for granted. I know I learned a great deal about what we need to be prepared for the next hurricane, so things will go better, hopefully. If you’re also in Houston and you don’t have power, I hope you get it really soon. It’s been so frustrating. I hope everyone and their families are well! Now on to this late post!

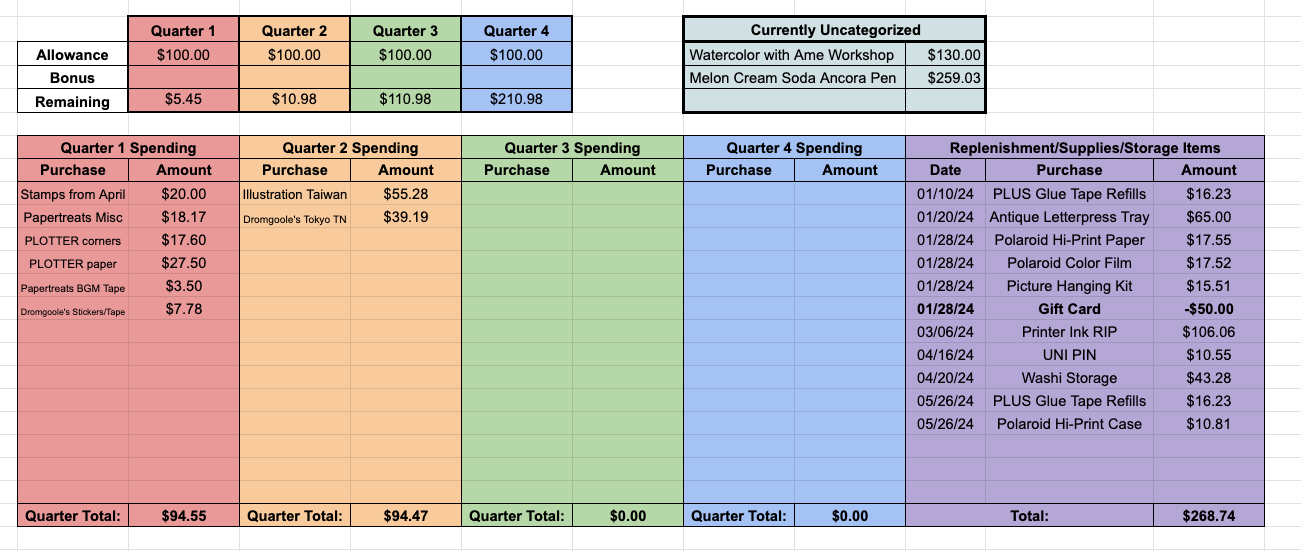

We’re halfway into July and over halfway through the year. Somehow, I’ve made it this far. I don’t know if anyone had any predictions on my perseverance, but the no-spend is still intact! No rules have been broken, and I’m still going strong.

Pen Dilemmas

I’ve been keeping a secret.

When I returned from my road trip last month, I found my Ancora Melon Cream Soda pen waiting for me. It feels like a special mid-year treat, and it hasn’t left my side since its arrival. It’s absolutely perfect, and I’m excited to see how Ancora continues the series.

As for the dilemma of categorizing this purchase, I’m leaning toward using my earnings from the California Pen Show to cover it. Here’s my secret: last year, I put my name on a waitlist for a very expensive handmade pen, and I recently received notice that my spot on the list is coming up soon. Which means I’ll have to pay for it! I’ve been wrestling with how to fit this expensive pen into my no-spend challenge. I’ll be paying for it this year, but since I planned for this pen last summer, long before the no-spend was conceived, does it even count as part of this year’s journey and budget?

Ultimately, I’ve decided that yes, it does count, since the whole original point of this no-spend was to save money and work on our debt. By paying for the Melon Cream Soda pen with my saved earnings from the pen show, I can free up the ability to make “one large purchase outside of the $100 allowances” as per my rules. So, when that pen is finally ready, it will still fit within the no-spend guidelines.

This change means I’ll have less money than originally planned for Stationery Fest and the San Francisco Pen Show. To offset this, I’m planning to earn a little extra money before then by doing some side work. I hope to attend these two shows without losing control and breaking the no-spend, but I worry there will be more exclusives and limited edition items than I can afford. Yes, I will be working both of those shows, so the pay will help offset spending, but I’ll have to budget and plan my purchases with specific intent.

What I’ve Learned

These past six months have taught me a lot about my self-control and ability to resist the temptation to buy things. I wish I could say it’s been easy, especially with the help of the quarterly allowance, but breaking old spending habits and saying no to cute new items is hard, especially now that I’ve reached a point where we’ve paid off a lot of the debts we started the year with. This is a point where I could easily stop and say I gave it a good run, mission mostly accomplished, lesson learned, etc.

Then I saw this meme:

For many in the stationery and fountain pen community (and beyond), this meme seems ridiculous. I’ve seen countless people drop that much and more on a single pen without a second thought. (I’m one of them.) Even on a “no-spend,” my budget is $400 for the year, and that increases when I factor in bonuses, extra earnings, and the one large purchase allowance. Just my replenishment and storage column has already surpassed $255. This highlights how easy it is to overspend on this hobby, even with the best intentions.

I know a much more extreme budget is possible, especially because some people are in situations where they cannot afford to spend even a single dime on hobbies. It’s a privilege to have extra money to spend on our hobbies. But many of us, including yours truly circa December 2023, have gotten into more expensive spending habits. When new stationery items come out, we crave them; we need them. We must have them, at any cost. But do we really need them, or are we hooked on the feeling of acquiring new stationery? I think a budget like $255 a year would be extremely difficult for many of us that have already gotten to a point where we may spend that much on a single order.

For example, back when I bought my first fountain pen, I agonized over the purchase. It was a Pilot Metropolitan, Silver, with a medium nib. Back in 2014, it was a $13 pen. I worried about the nib, because I didn’t know if I wanted a fine or a medium. I was spending a lot of money on this pen, and I needed it to be perfect because I wasn’t getting another one, possibly ever.

To the current me, it’s laughable. But back then, the 2014 version of me could never fathom the idea of spending more than $13 on a pen. Now the Pilot Metropolitan is $20+, and I think 2014 me would struggle even more to justify that amount. But every person, no matter where they are on their fountain pen journey, has a number in their head that they say they won’t go over. No matter how high, we all have our limits, right? But as new, tantalizing items come out and we continue to spend and pass certain thresholds, the lower thresholds disappear. And the higher thresholds don’t seem so high anymore.

Between the Metropolitan purchase and our trip to Japan in the spring of 2016, I continued to dabble in the lower-end market of pens. Before the trip, I knew I wanted to splurge on a fountain pen purchase. It would be a souvenir of sorts, so I researched for months until I made my decision. In Japan, I bought a simple metallic blue Pilot Vanishing Point and thought I would never spend that sort of money on a pen ever again. I told myself this was it; I got my one gold nib, I’ve reached the promised land, and I can go home and be happy forever.

Then I went back to Japan in 2019 and went off the deep end. I bought half a dozen Sailors, a Nakaya, and a raden Vanishing Point. Whoops.

After that, it felt like I’d broken the seal. Now that I’d passed that limit in my head, I couldn’t go back. I couldn’t put the genie back in the bottle. The threshold went up, my perception skewed, and it became easier to justify doing it again, and again, and again. Pre-no-spend, anything under $100 was an impulse buy, an easy purchase that needed no justification. Yes, larger purchases still needed to be within my means, but my perception of my means changed. I would say I hadn’t splurged on stationery in a while, so I deserved a nice treat, all while conveniently forgetting that I’d bought myself a treat the week before. I’d justify that I was able to afford and pay off the last $500 pen, so why not this one too? I spent money before I had it, borrowing from the future. And that’s where we get into the territory of debt. And going to debt for your hobbies is never a good idea.

So has the no-spend changed my perception? Was I able to lower my thresholds again?

Yes, and no.

I’d love to say six months of this challenge has cured my addiction to spending, but no. I see an item I want and have to stop my brain from justifying the purchase. That new Rickshaw is cute; I don’t really need it, but I could buy it and count it as storage, right? If I put an item in the Amazon cart and my husband buys it without asking me first, it doesn’t count, right? The Superior Labor bags and pouches are all storage and they don’t count toward my no-spend! My brain loves coming up with new ways to cheat the system, and I have to fight that urge every time.

Overall, I feel like I’m becoming more satisfied with what I have, and when I see a new item, I’m less compelled to buy it just because it’s cute. I have to see an actual use or need for that item. This goes for all other purchases as well. As I mentioned in the road trip post, I didn’t feel the need to buy extra things on our vacation. Other than a bag I’ve been wanting for a while, I didn’t purchase anything else. I do feel like temptation is lower, especially for impulse purchases.

I’m in a continuous state of reminding myself of my goals, why I’m doing this, and what I’m trying to accomplish. I don’t want to get back into a situation where I’m paying interest on items I just had to have. Or the trap of buying an item I can’t afford because it’s on sale, just for interest charges to negate that discount. Instead, we actually have money in savings, we’ve paid off most of our debts (house and one car excluded), and I’m not stressing out over money.

I’m not saying any of this to shame people for their spending or cast blame. We are all in different situations, and there are a lot of negative things happening in the world right now. Our hobbies help us take our mind off of heavy topics. Journaling is an effective way to sort through our feelings. There is nothing wrong with collecting stationery, so please don’t read this and feel like I’m attacking you. I hope, instead, to inspire you to take another look at what you already have and find happiness from using it, rather than acquiring new things. And when we are tempted to buy a new item, to think about why we want it.

At the very least, I suggest to everyone: track your hobby spending. You don’t have to go on a no- or low-spend to get an idea of how much you’re spending on stationery. You may be surprised when you add up the cost. And yes, I know a lot of us joke about never adding it up, but with rising costs of…everything, I think it’s a good idea to pay a little more attention to where our money is going.

One last note: these past six months have also taught me so much about the generosity of my friends. Many people have gifted me stationery samples, stamps, stickers, ephemera, even a pen! These gifts have helped me along and given me new things to look forward to when I sit down to journal. I find myself excited to incorporate them into my stash.

Less is more, and I’ve become better acquainted with my supplies and more appreciative of what I have. I’ve used several pieces of ephemera I had hoarded for special occasions or didn’t know what to do with. And I could use them simply because I no longer had the distraction of shiny new purchases blocking out the things I already had.

So that’s how things are going. Since it’s a new quarter, I have another $100 in my pocket, bringing my current allowance to $110.98. I plan to save as much as I can for August, so I’m trying not to buy anything in July if I can help it.

Okay, last last note: July and August are going to be extremely busy months, and I’m also pushing to finish my book over this time. For July and August, I’m planning to write only one post at the end of each month, to protect my sanity. (This one doesn’t count.) I will continue to track my spending in the spreadsheet, which is always accessible if anyone wants to check and keep me accountable.

Thanks for reading! If you’ve made it this far and you’re not a subscriber already, make sure you subscribe! All the no-spend updates are free!

I enjoy comments and feedback, so let me know what you think of my progress so far! If you’re also on a no-spend or low-spend, let me know how it’s going!

I also have a little tip jar! Any tips or paid subscriptions directly go into my “quit my job to write full-time someday” savings account.

Good post and good job. I'm trying to get one big bill off my plate before the end of 2024. I'm praying that Hurricane Season doesn't derail me from that.